When purchasing health insurance, understanding the waiting periods is crucial. Insurance providers impose waiting periods to mitigate risk and ensure that policies are used for their intended purpose. Let’s dive into the three most common waiting periods you should be aware of when buying a new health insurance policy.

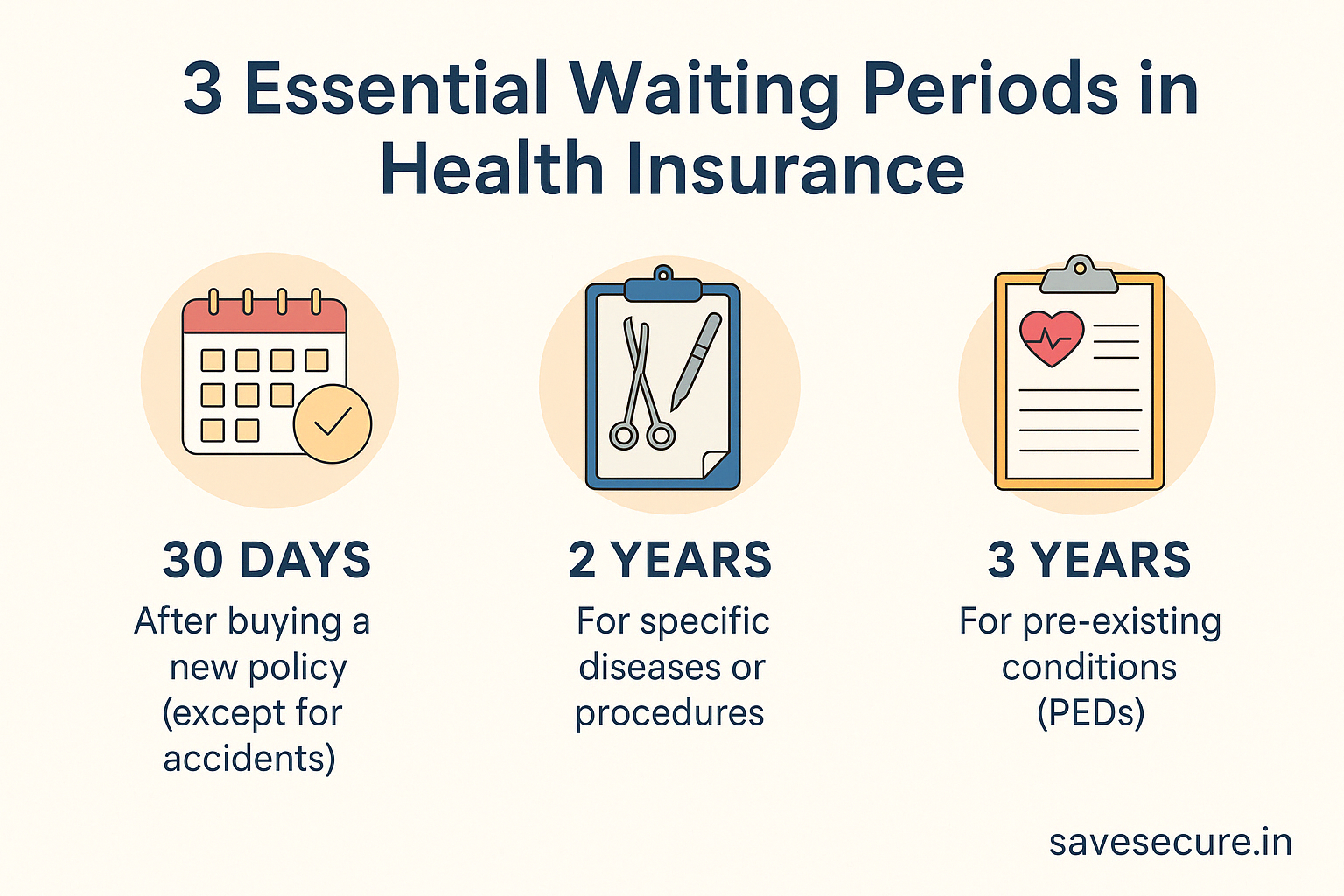

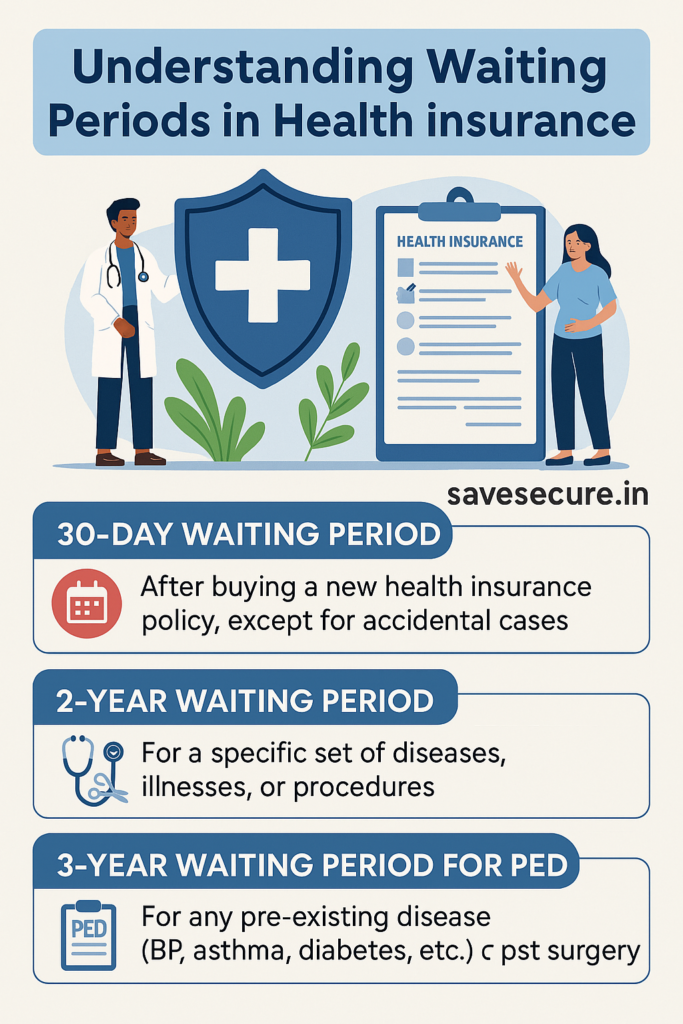

1. 30-Day Waiting Period

When you purchase a new health insurance policy, there is typically a 30-day waiting period before you can claim coverage. During this period, the insurance company will not cover any medical expenses, except for those arising from accidents. This waiting period is a safeguard for insurers, as it prevents people from purchasing insurance only when they anticipate needing medical care immediately.

Important Note: Accidental injuries are typically covered right away, meaning if you are involved in an accident during this 30-day window, your policy will kick in.

2. Two-Year Waiting Period

Many health insurance policies have a 2-year waiting period for certain specific diseases, illnesses, or medical procedures. This usually includes conditions like:

- Surgeries (except those arising from accidents)

- Certain chronic diseases (e.g., cancer, joint replacement)

- Specific treatments (e.g., infertility treatments, cataract surgery)

This period ensures that the policyholder doesn’t purchase insurance just to cover pre-existing conditions or conditions that are likely to require expensive treatments shortly after policy issuance.

Note: Conditions like cataract surgery, joint replacement, and other planned surgeries are typically subject to this waiting period.

3. Three-Year Waiting Period for Pre-Existing Diseases (PED)

For pre-existing diseases (PED), such as diabetes, hypertension, asthma, and any past surgeries, there is usually a waiting period of 3 years. This waiting period ensures that people with ongoing medical issues don’t immediately benefit from expensive health insurance claims related to those pre-existing conditions.

Example: If you have been diagnosed with high blood pressure or diabetes, these conditions will not be covered by your health insurance policy for the first three years. Similarly, if you have had surgery in the past, claims related to those surgeries are generally excluded during this period.

Note: While the general rule is a 3-year waiting period for PEDs, some policies may offer a 1-year waiting period instead. Have you checked your policy details? If not, feel free to Whatsapp me your mediclaim plan name, and I’ll guide you through the specifics!

Disclaimer

I am a certified Health & Term Insurance Advisor and not an insurance company. The information shared is intended to help you understand policy options and make informed decisions. Final terms, benefits, and conditions are subject to the respective insurance provider’s official documentation. Always read the policy brochure and consult with the insurer before purchasing.