In Vitro Fertilization, commonly known as IVF, is a medical procedure that helps couples struggling with infertility to conceive a child. It involves fertilizing an egg with sperm outside the body in a laboratory, and then implanting the embryo into the uterus. IVF has brought hope to millions of families worldwide and is one of the most widely used forms of Assisted Reproductive Technology (ART). With rising awareness and advancements in medical science, IVF is becoming more accessible—but the financial cost can be significant, making insurance coverage an important consideration for many.

What is IVF Treatment?

IVF (In Vitro Fertilization) is a type of Assisted Reproduction Treatment (ART) where an egg and sperm are fertilized outside the body and implanted into the uterus. It is often recommended for couples struggling with infertility.

IVF Insurance Coverage in India

Traditionally, IVF and fertility treatments were not covered under most health insurance plans in India, as they were seen as or non-essential procedures. Couples had to bear the full cost themselves, which could run into lakhs per cycle.

In recent years, however, some insurers have begun offering limited IVF coverage under select maternity or women-specific health plans. These policies usually cover one IVF cycle per year, with conditions like waiting periods, age limits, and cost caps.

While still not widespread, this inclusion is a welcome move, helping reduce the financial burden for couples seeking fertility support. It’s important to carefully read policy terms or consult an advisor before choosing a plan.

Benefits of IVF Coverage

- IVF treatment is costly, but insurance helps reduce the burden.

You can save a lot on doctor fees, tests, and hospital charges. - Covers important parts of IVF like tests, injections, and procedures.

Some policies even include embryo freezing and hormonal therapy. - You get access to trusted hospitals and fertility clinics.

Insurance often ties up with quality centers for better care. - You can plan early and use the policy when needed later.

Waiting periods of 2–4 years make early planning useful.

How to Choose IVF Insurance

- Coverage of IVF included or not – Check if the policy clearly mentions coverage for IVF or fertility treatment (often under maternity or ART benefits).

- Coverage Limit – See how much the insurance will pay for IVF – Make sure it’s enough for expected costs.

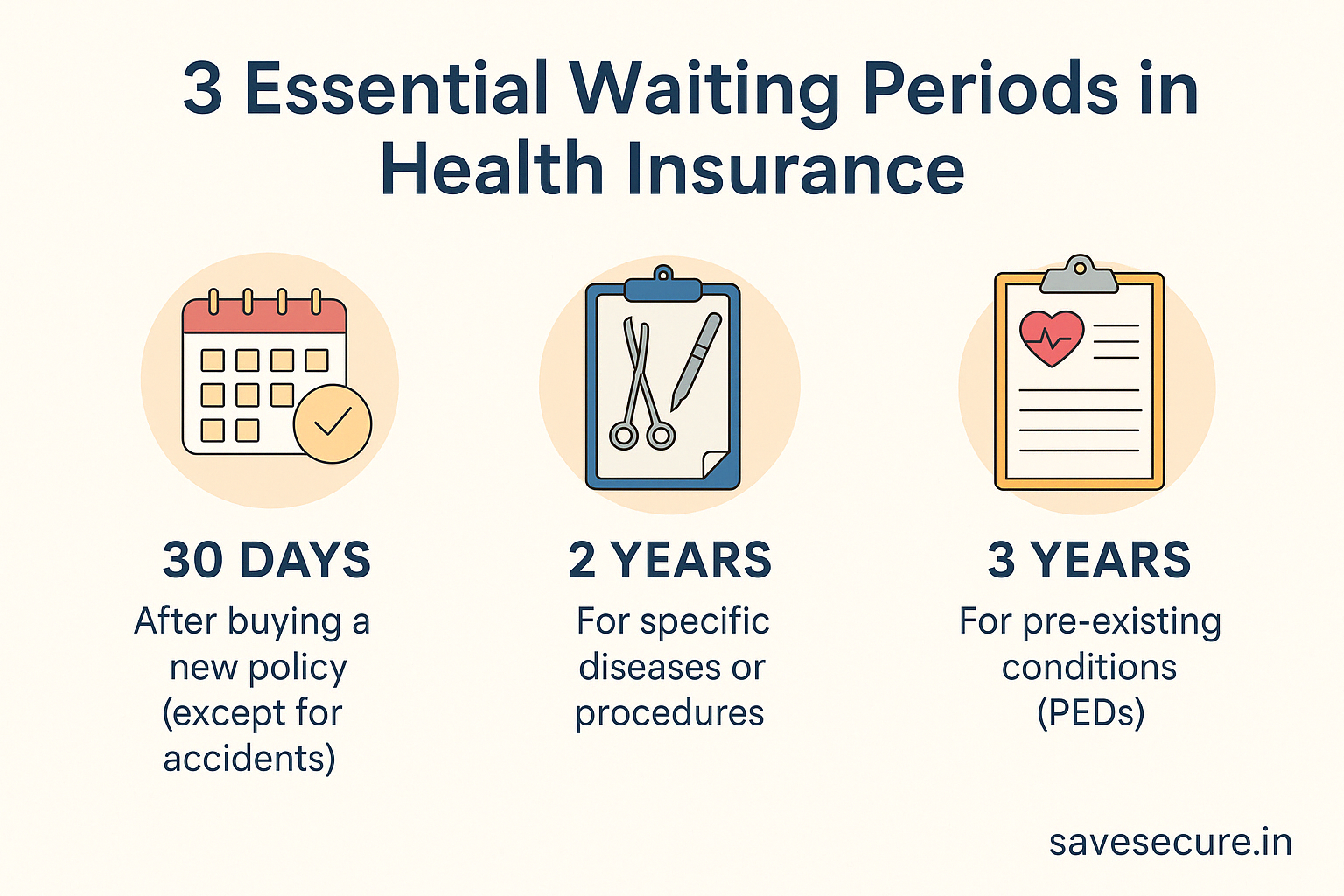

- Waiting period – Many policies have a 1 to 4-year waiting period before IVF benefits start. Choose early if planning treatment in the future.

- Network Hospitals – Check if IVF is covered only at certain empanelled hospitals/clinics. You’ll need to go there for coverage to apply.

Insurance Provider Comparison

| Plan | IVF Coverage limit | Waiting period | Frequency/ Terms |

| Star Health Assure Policy | upto 4 Lacs | 24 months from the date of first inception of the policy. | Once ART in a policy year |

| Star Women Care Insurance Policy | upto 3 lakhs | 36 months from the date of first inception of the policy. | Once per Policy Tenure/year |

| HDFC Ergo(Parenthood) | upto 2 lakhs | 12 to 48 months depending on the insurer. | Once in every 3 years cycle |

| ICICI Lombard | upto 2 lakhs | 36 months depending on specific plan | depends on policy |

“The above mentioned data regarding IVF plans are current as of 2nd August 2025”

FAQ’s

Disclaimer

I am a certified Health & Term Insurance Advisor and not an insurance company. The information shared is intended to help you understand policy options and make informed decisions. Final terms, benefits, and conditions are subject to the respective insurance provider’s official documentation. Always read the policy brochure and consult with the insurer before purchasing.

Pingback: Common Reasons for Claim Rejection: 7 Costly Mistakes You Must Avoid in 2025 - Save Secure