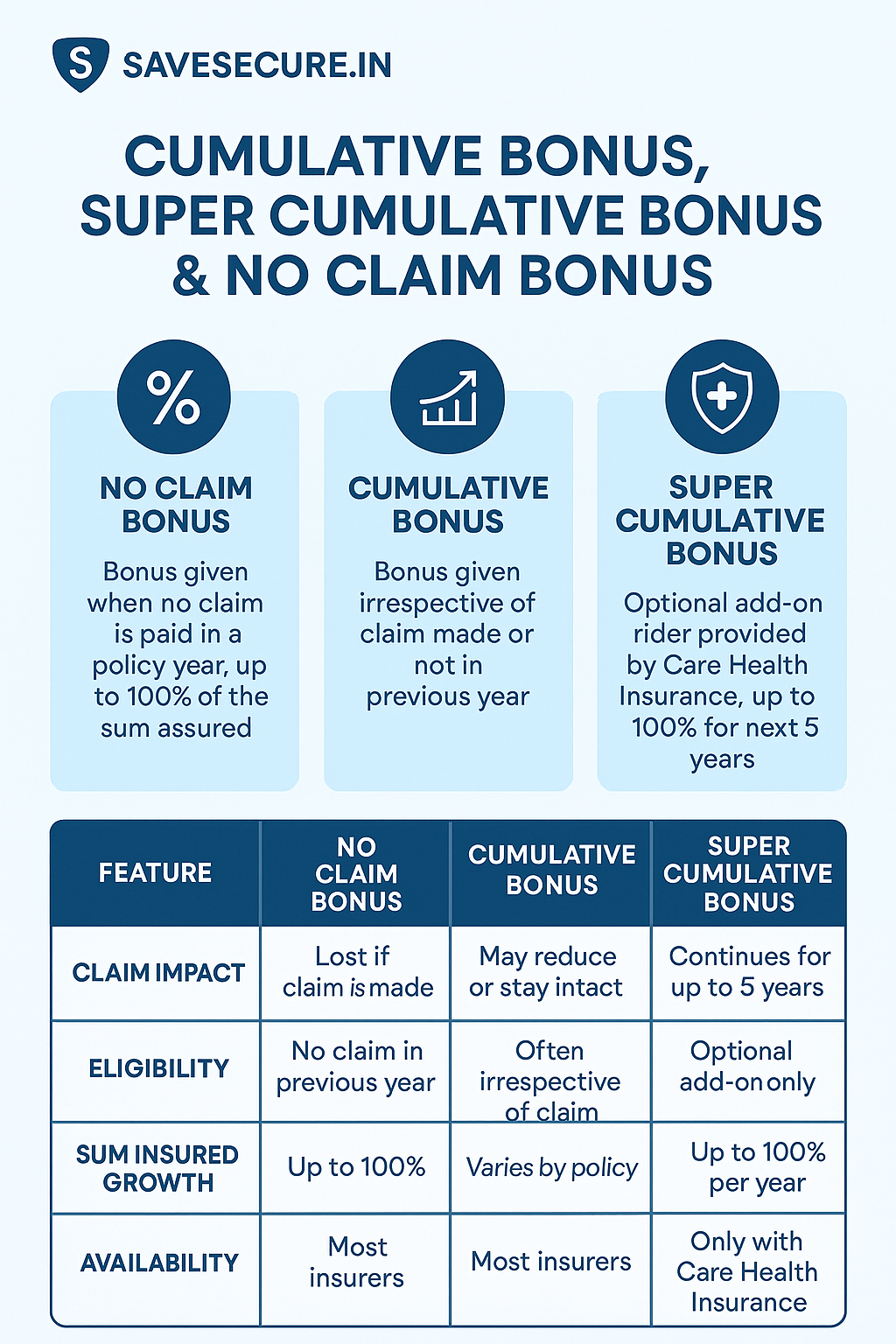

When buying or renewing a health insurance policy, terms like No Claim Bonus (NCB), Cumulative Bonus, and Super Cumulative Bonus often come up. While they may sound similar, they work differently — and knowing the difference can help you choose a policy that truly benefits you over the long run

What is No Claim Bonus (NCB)?

No Claim Bonus is a reward offered by health insurance companies for not making any claim in a policy year. If you don’t file a claim during the year, a certain percentage of your sum insured is added as a bonus when you renew your policy.

- This bonus typically ranges between 5% to 50%, depending on the insurer and the plan.

- The bonus increases your sum insured, not the premium.

- However, NCB is applicable only if no claim was made in the previous policy year.

- The bonus amount is usually capped at 100% of the base sum insured.

Example: If you have a ₹5 lakh policy and 10% NCB, and you don’t make a claim, your renewed sum insured becomes ₹5.5 lakh. But if you make a claim, the NCB resets to zero.

What is Cumulative Bonus?

Unlike NCB, Cumulative Bonus is an incremental benefit provided every year, regardless of whether a claim was made or not.

- It automatically increases your sum insured year after year.

- Some policies may still reduce the bonus if a claim is made, but many modern plans continue offering a cumulative benefit even after claims.

- The percentage bonus and terms vary based on the policy.

🔁 This makes Cumulative Bonus more consistent compared to NCB, especially for those who might need to make small claims but still want rewards for continuity.

What is Super Cumulative Bonus?

Super Cumulative Bonus is an optional rider offered by Care Health Insurance that significantly boosts your bonus benefits.

- It offers additional bonus over and above the regular cumulative bonus.

- The bonus can go up to 100% of the sum insured each year.

- This benefit is available for up to 5 consecutive years, helping your sum insured grow substantially.

💡 Ideal for those who want maximum coverage over time, especially with rising medical costs.

| Feature | No Claim Bonus (NCB) | Cumulative Bonus | Super Cumulative Bonus (Care Health) |

| Claim Impact | Lost if claim is made | May reduce or stay intact | Continues for up to 5 years |

| Eligibility | No claim in previous year | Often irrespective of claim | Optional add-on only |

| Sum Insured Growth | Up to 100% | Varies by policy | Up to 100% per year |

| Availability | Most insurers | Most insurers | Only with Care Health Insurance |

Final Wordings

Choosing the right bonus feature can help you enhance your health insurance coverage without increasing your premium drastically. If you’re someone who rarely makes claims, NCB might benefit you. But if you’re looking for steady long-term benefits, Cumulative Bonus or Super Cumulative Bonus (especially from Care Health) could be better choices.

Have questions about your health policy or want to understand which bonus suits you best? Feel free to reach out for a personalized consultation.

Disclaimer

I am a certified Health & Term Insurance Advisor and not an insurance company. The information shared is intended to help you understand policy options and make informed decisions. Final terms, benefits, and conditions are subject to the respective insurance provider’s official documentation. Always read the policy brochure and consult with the insurer before purchasing.