Health insurance is your financial safety net during tough medical emergencies. Yet, many policyholders face a frustrating situation — claim rejection. Understanding the common reasons for claim rejection can help you protect your financial stability and ensure that your insurance claim is processed smoothly

Understanding Claim Rejection in Health Insurance

What Is a Claim Rejection?

A claim rejection occurs when your insurance provider refuses to pay for medical expenses due to certain conditions not being met. This can happen before or after hospitalization, and sometimes, even a small oversight in the paperwork or medical disclosure can lead to rejection.

Difference Between Claim Rejection and Claim Denial

While these two terms are often used interchangeably, they differ slightly:

- Claim Rejection: The insurer refuses the claim due to missing or incorrect information.

- Claim Denial: The insurer reviews the claim but decides it’s not payable under policy terms.

The Importance of Accurate Information in Your Policy

Why Declaring Pre-Existing Diseases Matters

Pre-existing diseases (PEDs) refer to any medical conditions diagnosed before the policy start date, such as diabetes, hypertension, or thyroid disorders. Insurance companies assess the risk based on these conditions. If not disclosed, your insurer can legally reject your claim later.

What Happens If You Miss a Pre-Existing Disease Declaration

If you forget to declare a disease and later mention it to the doctor during hospitalization, the insurer may reject the claim. Even if the disease developed after the policy date, failure to declare previous conditions raises doubts about your transparency.

Example Scenario: PED Declaration Missed but Mentioned at Hospitalization

Let’s say you bought your health policy in January 2024 and were diagnosed with diabetes in March 2024. In December 2024, you were hospitalized and mentioned diabetes in your admission papers. The insurer may reject the claim if they suspect it existed before policy inception.

Common Reasons for Claim Rejection

1. Non-Disclosure or Misrepresentation of Pre-Existing Diseases

Failing to declare your health history is one of the top causes of claim rejection. Always disclose conditions like hypertension, thyroid, or asthma — even if they seem minor.

2. Hospitalization Was Not Medically Necessary

Some claims get rejected because the treatment could have been done on an outpatient basis. If your hospitalization wasn’t essential (like for observation or minor ailments), the insurer might deny the claim.

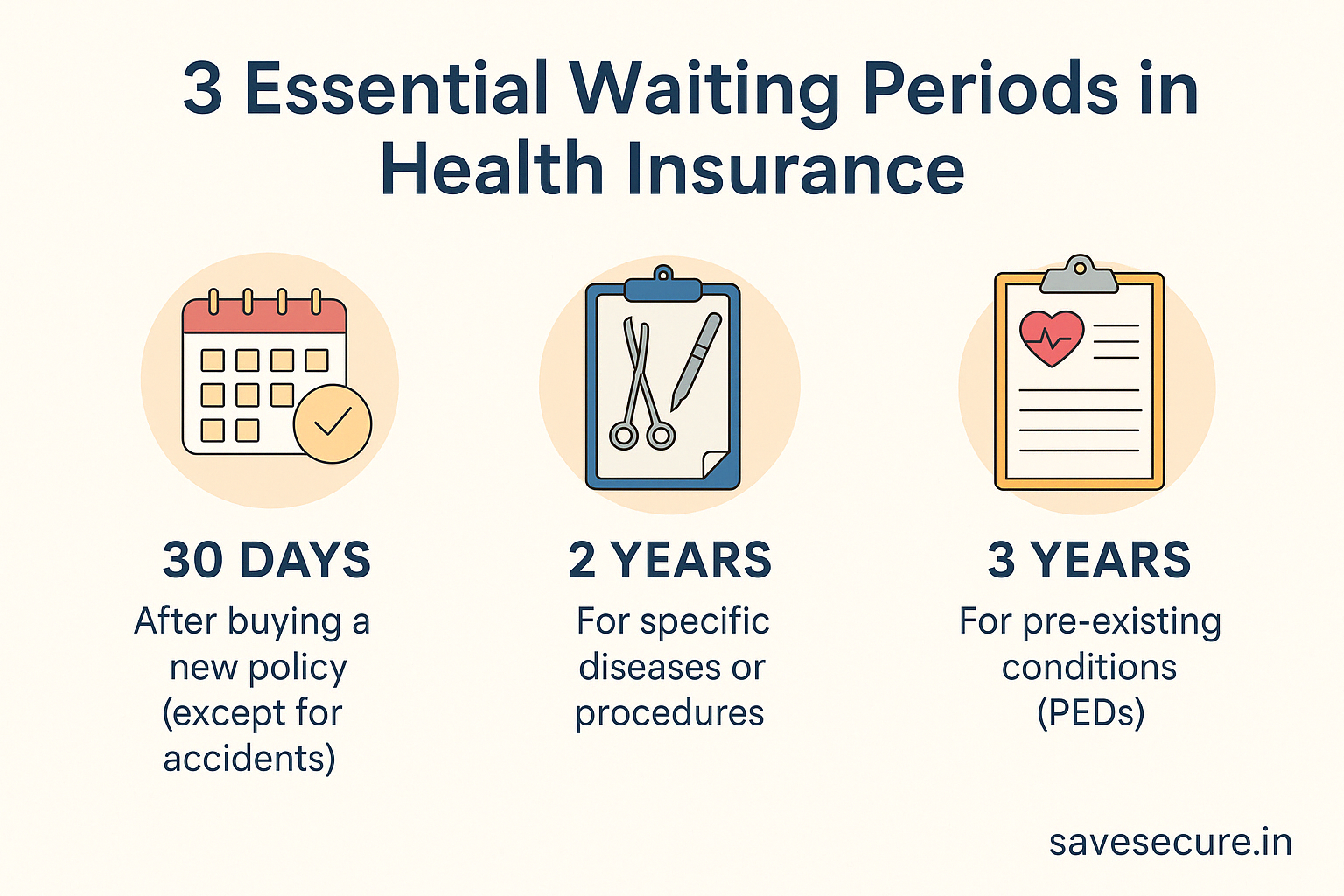

3. Waiting Period Not Completed

Health policies have different waiting periods:

- 30 days for new policies (except accidental hospitalization)

- 2 years for specific diseases (like hernia or cataract)

- 3 years for pre-existing conditions

If you’re hospitalized before the waiting period ends, your claim may not be approved.

4. Cosmetic or Elective Surgeries

Procedures like plastic surgery, hair transplants, or dental implants (unless injury-related) are excluded from standard health insurance coverage.

5. Terror Attack or War-Related Injuries

Most health insurance policies exclude claims related to war, riots, or terror attacks. Always check the “General Exclusions” section before filing.

6. Treatment Not Covered Under Policy Terms

If your treatment falls outside the list of covered diseases or involves unrecognized hospitals, your claim may be rejected.

7. Late or Incomplete Claim Submission

Submitting claims after the deadline or with missing documents (like discharge summaries or diagnostic reports) is another common reason for rejection.

8. IVF Coverage – Only some plan covers

Not all policies covers IVF so if your policy does not cover IVF and you tried to claim then your claim may be rejected so make sure to check policy papers.

Click on this link to know more about IVF coverage in Health Insurance

Other Exclusions as per Policy Document

These exclusions vary by insurer; always refer to your policy wording for full details.

The following are some standard exclusion categories mentioned in most Indian health insurance policies (for example, under codes Excl 03–38). These are shared here for educational purposes only — always refer to your own policy wording for full details and applicability

- 30-Day Waiting Period – Code Excl 03

- Investigation & Evaluation – Code Excl 04

- Rest Cure, Rehabilitation and Respite Care – Code Excl 05

- Obesity / Weight Control – Code Excl 06

- Change-of-Gender Treatments – Code Excl 07

- Cosmetic or Plastic Surgery – Code Excl 08

- Hazardous or Adventure Sports – Code Excl 09

- Breach of Law – Code Excl 10

- Excluded Providers – Code Excl 11

- Treatment for Alcoholism, Drug or Substance Abuse – Code Excl 12

- Treatments Requiring Rest or Isolation – Code Excl 13

- Dietary Supplements and Substances – Code Excl 14

- Refractive Error – Code Excl 15

- Unproven Treatments – Code Excl 16

- Sterility and Infertility – Code Excl 17

- Maternity – Code Excl 18

- Circumcision – Code Excl 19

- Congenital External Conditions / Defects / Anomalies – Code Excl 20

- Convalescence, General Debility, Run-Down Condition, Nutritional Deficiency States – Code Excl 21

- Intentional Self-Injury – Code Excl 22

- Injury or Disease Caused by War or Invasion – Code Excl 23

- Injury or Disease Caused by Nuclear Weapons / Materials – Code Excl 24

- Expenses Incurred on Enhanced External Counter Pulsation Therapy and Similar Procedures – Code Excl 25

- Unconventional, Untested, Experimental Therapies – Code Excl 26

- Autologous Derived Stem Cell Therapy and Similar Procedures – Code Excl 27

- Rich Plasma and Intra-Articular Injection Therapy – Code Excl 28

- Biologics, Except When Administered as Inpatient – Code Excl 29

- Inoculation or Vaccination (Except Post-Bite Treatment) – Code Excl 31

- Hospital Registration Charges and Similar Non-Medical Expenses – Code Excl 34

- Cost of Spectacles, Hearing Aids, and Similar Devices – Code Excl 35

- Hospitalizations Not Medically Necessary – Code Excl 36

- Other Excluded Expenses as per Policy Schedule – Code Excl 37

- Existing Diseases / Conditions Declared by Insured – Code Excl 38

How to Avoid Claim Rejection: Smart Policyholder Tips

- Always Disclose All Medical Conditions Honestly — Be transparent, even about minor health issues.

- Understand the Waiting Periods — Don’t file claims before the waiting period is over.

- Keep All Hospital Documents — Maintain prescriptions, bills, and test results.

- Review the Policy Exclusions Carefully — Know what’s covered and what’s not.

Real-Life Case Studies: Why Claims Get Rejected

Case Study 1: Pre-Existing Disease Missed During Policy Purchase

Mr. Kunjbihari failed to declare his hypertension while buying a policy. Later, when he was hospitalized for a cardiac issue, the insurer rejected the claim due to nondisclosure.

Case Study 2: Non-Essential Hospitalization

Ms. Kunjbihariwas admitted for a viral fever that could have been treated with medication. Her insurer rejected the claim as the hospitalization was not medically necessary.

What to Do If Your Claim Is Rejected

Steps to File a Reconsideration or Appeal

- Contact your insurer and request a written explanation.

- Provide missing or corrected documents.

- File a grievance with the insurer if you disagree with the decision.

Role of the Insurance Ombudsman

If your appeal isn’t resolved within 30 days, you can approach the Insurance Ombudsman for a free, impartial review of your case.

👉 Visit the official IRDAI website for detailed grievance redressal: https://irdai.gov.in

Frequently Asked Questions (FAQs)

1. Can I reapply if my claim is rejected?

Yes, you can reapply with supporting documents and a written explanation.

2. Will my future claims be affected by one rejection?

No, unless the rejection was due to fraud or false information.

3. Are mental health treatments covered?

Yes, most insurers now include mental health under IRDAI guidelines.

4. What if I didn’t know about my pre-existing disease?

If it’s genuinely undiagnosed, provide proof and medical history during appeal.

5. How long does claim settlement usually take?

Typically, within 15–30 working days after document submission.

6. What are the most common exclusions in health insurance?

Cosmetic surgeries, fertility treatments, and war injuries are commonly excluded.

Conclusion: Be Transparent, Be Protected

Insurance is built on trust. By being honest, reading your policy terms carefully, and keeping your medical documents in order, you can avoid claim rejections and safeguard your financial future.

Remember: Transparency today prevents disappointment tomorrow.

Disclaimer

I am a certified Health & Term Insurance Advisor and not an insurance company. The information shared is intended to help you understand policy options and make informed decisions. Final terms, benefits, and conditions are subject to the respective insurance provider’s official documentation. Always read the policy brochure and consult with the insurer before purchasing.