Choosing the right health insurance plan for your family can be confusing — especially when you’re deciding between a Group Health policy and Individual Health Insurance. Both options offer coverage for medical expenses, but they work differently and suit different need, like in case of individual health insurance you will get benefit of money back, renewal guarantee, pre & post medical expenses coverage etc.

hence here in this blog we will understand individual & group(corporate) health insurance meaning & differences.

What is Individual Health Insurance?

A policy purchased by a person to cover their own medical expenses or that of their family. Health insurance for individuals acts as a protection against unprecedented medical expenditures. Individuals can tailor their coverage to their specific needs, choosing from various options and add-ons to enhance their plan.

example : Mr. kunjbihari, a 35-year-old professional, purchased an individual health insurance policy with ₹5 lakh coverage. A few months later, he was hospitalized for dengue, and his medical bill was ₹1.8 lakh. His insurer covered the full amount, and he was able to choose a private room as per his policy. Since the policy is independent of his job, it remains active even if he changes employment, ensuring continuous protection.

What is Group (Corporate) Health Insurance?

A group insurance policy refers to a group of peoples particularly like families, members of an organisation, employees. Often, group health insurance extends coverage to an employee’s family members, such as spouses, children, and sometimes parents.

example : Mrs. Anjali, a 40-year-old marketing manager, was covered under her company’s group health insurance for ₹3 lakhs. When her son needed surgery, the policy covered the cost without any waiting period or paperwork. Since it was part of her job benefits, she didn’t pay any premium. However, after resigning from the company, the policy automatically ended, and she had no health cover until she bought an individual policy later.

Individual health insurance Vs Group(Corporate) health insurance

Individual Health Insurance Policy

1.You get full claim support– An advisor can assist you throughout the claim process for a smooth experience.

2. Includes Latest Benefits like money-back options, home care, unlimited restoration, wellness rewards, etc.

3. You have an option to Port your policy to another Insurer without losing benefits.

4. Renewal Guarantee – You can keep renewing the policy every year, even after retirement.

5. No sublimits, You can choose your plan with no limits on Room Rent, Surgeries etc.

6. No Claim loading or Sharing Your coverage stays the same, and premium doesn’t increase even if you make a claim.

7. In Individual Health Insurance many plans covers medical expenses even before or after Hospitalisation not just during your hospital stay.

Group (Corporate) Health Insurance Policy

1. At the time of claim process no banker will assist you or help you for claim settlement .

2. No Latest Benefits like money back, Home care, Unlimited restoration of sum assured etc.

3. No portability – Unlike Individual you cannot convert or shift your existing policy to another insurance company.

4. In Corporate insurance policy there is no Policy renewal guarantee

5. There are several Corporate policies have Sublimits on there Room rents, Surgeries and so on Expenses.

6. Claim loading or sharing – Insurer may reduce coverage or increase premium.

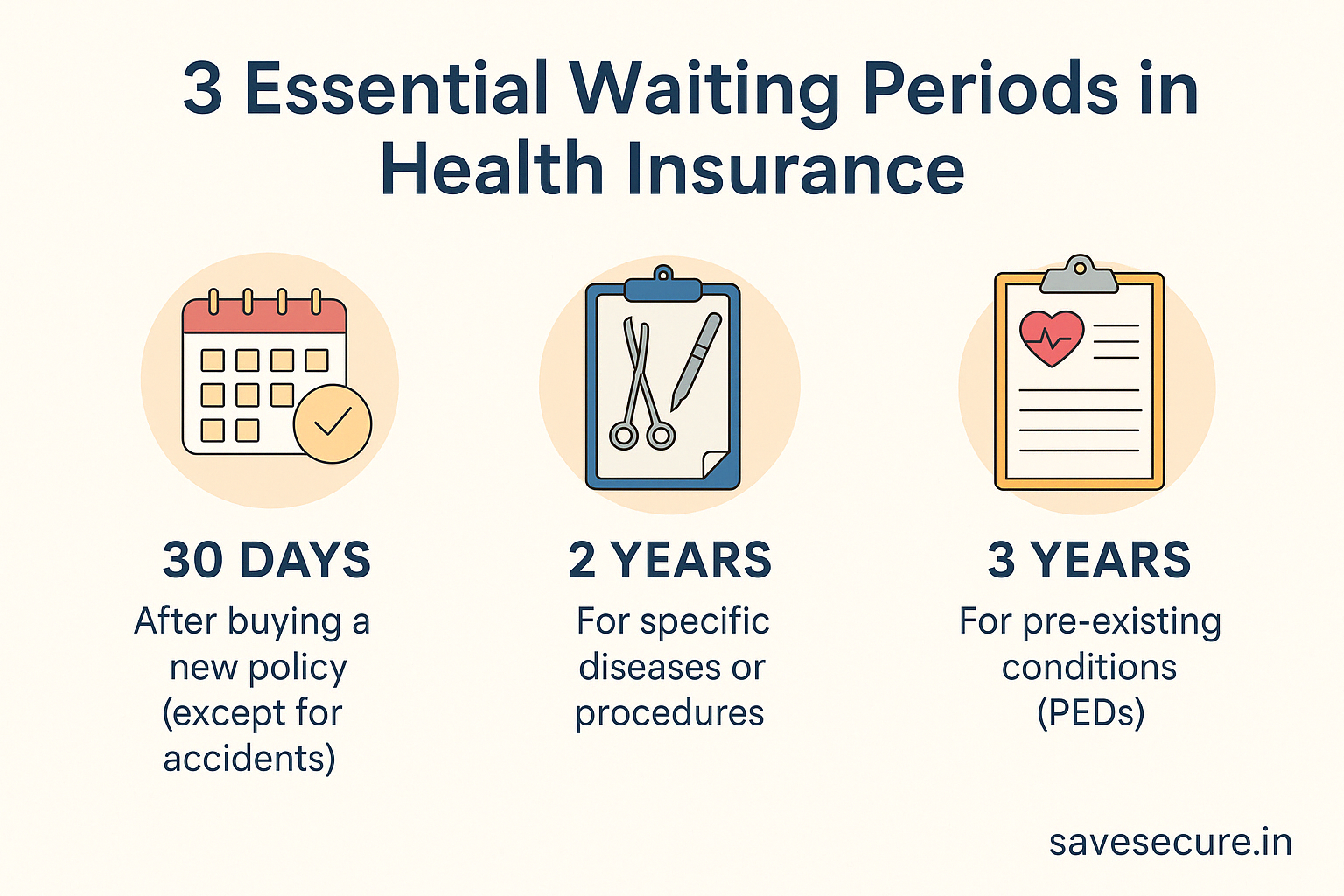

7. These plans often cover only 30 days before and 60 days after hospital admission. If your treatment takes longer, it won’t be paid for.

Disclaimer

I am a certified Health & Term Insurance Advisor and not an insurance company. The information shared is intended to help you understand policy options and make informed decisions. Final terms, benefits, and conditions are subject to the respective insurance provider’s official documentation. Always read the policy brochure and consult with the insurer before purchasing.

Pingback: The Hidden Trap in ‘Free’ Travel Insurance with Holiday Packages - Save Secure